The article is written by Dipendra Jain (Partner) at Jain Doshi & Co.

Introduction

The timely payment of dues to Micro, Small, and Medium Enterprises (MSMEs) plays a vital role in fostering a robust business ecosystem. However, delayed payments continue to affect MSMEs, impacting their financial health and growth. To address this issue, amendments to the Income-tax Act through Section 43B(h) were introduced, emphasizing the importance of adhering to payment timelines for transactions with MSMEs. These changes aim to discourage delays, promote compliance, and strengthen the financial stability of MSMEs.

The MSME Development Act, 2006: Overview and Relevance

The MSME Development Act, 2006, was enacted to promote, develop, and enhance the competitiveness of MSMEs. It classifies enterprises into micro, small, and medium categories based on investment and turnover criteria. In 2020, these classifications were revised to enable more businesses to benefit from government schemes.

One of the Act’s critical features is its provisions to combat delayed payments. Sections 15 and 16 mandate strict timelines for dues, with a maximum permissible limit of 45 days from the date of acceptance of goods or services. If payments are delayed, MSMEs are entitled to interest, compounded monthly at three times the Reserve Bank of India’s (RBI) bank rate.

Section 43B of the Income-tax Act: Overview and Amendments

Section 43B of the Income-tax Act regulates deductions for certain expenses by allowing them only on an actual payment basis. In 2023, Clause (h) was introduced under the Finance Act, targeting payments to micro and small enterprises.

New Deduction Norms for Payments to MSMEs – Section 43B(h)

Clause (h) specifies that amounts due to a micro or small enterprise that are not paid within the period prescribed under Section 15 of the MSME Act will only be deductible in the fiscal year in which they are paid, regardless of the accounting method used. This ensures that deductions are linked to actual payment dates, compelling businesses to make timely payments to MSMEs.

Applicability of Section 43B(h)

Section 43B(h) applies when enterprises purchase goods or services from suppliers registered under the MSME Development Act, 2006. Importantly, the buyer’s registration under the MSMED Act is not a prerequisite for this provision to apply. Businesses must verify their suppliers’ MSME registration to avoid non-compliance. This provision will take effect from April 1, 2024.

Legal Framework for Payment Deadlines: Section 15 of the MSME Act

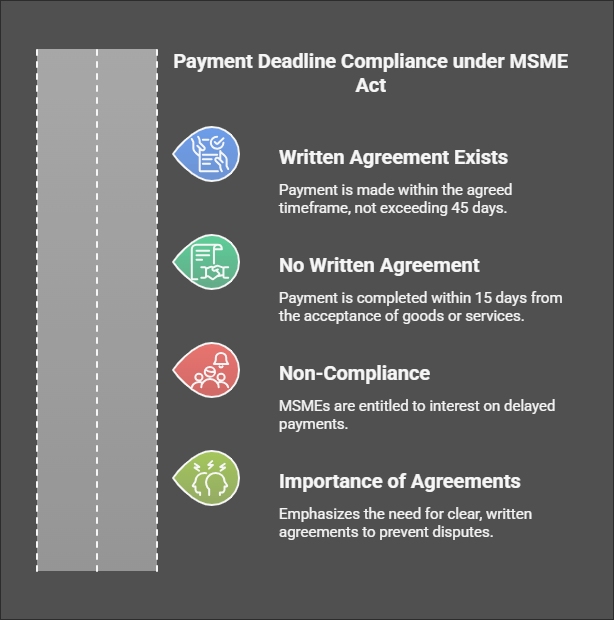

Section 15 of the MSME Act establishes strict payment deadlines:

- If there is a written agreement, payments must be made within the agreed timeframe, not exceeding 45 days.

- In the absence of a written agreement, payments must be completed within 15 days from the acceptance of goods or services.

Non-compliance entitles MSMEs to interest on delayed payments, creating a legally enforceable framework. This provision underscores the importance of clear, written agreements to prevent disputes and ensure accountability.

Benefits of Clause (h) of Section 43B for MSMEs

The inclusion of Clause (h) in Section 43B brings several benefits for MSMEs and larger businesses:

- Smooth Payment Cycle: It ensures that large companies settle dues with MSMEs within the specified timeframe of 15 days (without a written agreement) or 45 days (with an agreement), fostering liquidity and growth for MSMEs.

- Better Bargaining Power: By enforcing tangible consequences for delays, the provision empowers MSMEs to negotiate more confidently with larger entities.

- Reduced Disputes: Timely payments mitigate disputes and legal conflicts, creating a healthier and more collaborative business environment.

Implications of Delayed Payments under Section 43B(h)

The introduction of Section 43B(h) places a significant onus on businesses to prioritize payments to MSMEs:

If payments are delayed beyond the statutory timeline, deductions for such payments are disallowed in the tax return until the payments are actually made.

Section 43B(h) and Its Non-Applicability to Traders

Section 43B(h) applies exclusively to manufacturers or service providers registered as MSMEs under the MSMED Act. Wholesale and retail traders, while eligible for Priority Sector Lending benefits, are not covered under this provision.

Example:

- Mr. A purchases goods from Mr. B, a trader. Section 43B(h) does not apply in this case because Mr. B, as a trader, is not eligible for benefits under the MSMED Act.

Practical Considerations for Businesses

To ensure compliance with the MSMED Act and Section 43B(h), businesses should adopt the following practices:

- Written Agreements: Draft clear agreements with MSMEs that specify payment terms adhering to the MSMED Act’s timeline.

- KYC Processes: Verify suppliers’ MSME registration by requesting their Udyam Registration Certificate.

- Payment Tracking: Implement systems to monitor payment deadlines, particularly for MSME suppliers, to avoid disallowance of tax deductions.

- Auditing and Disclosures: Furnish detailed information about payments to MSMEs, including outstanding amounts and interest dues, in audited financial statements.

Conclusion

The integration of MSME payment obligations into the Income-tax Act through Section 43B(h) marks a pivotal step in addressing delayed payments. By ensuring timely payments to registered MSMEs, the provision promotes financial stability and growth for these enterprises. However, businesses must remain vigilant, addressing ambiguities and ensuring compliance through robust systems and clear agreements.

Through timely payments, reduced disputes, and strengthened compliance, businesses can foster a more equitable and efficient business ecosystem, supporting MSMEs as a cornerstone of the economy.

If you have any legal queries or require legal assistance, you can book a consultation with me: “Click Here”

Dipendra Jain is a distinguished professional with extensive expertise in taxation matters and portfolio management services. A fellow member of the Institute of Chartered Accountants of India (ICAI). In addition to his proficiency in taxation, Dipendra Jain provides comprehensive corporate legal advisory services, including company incorporation, MSME Udyam registration, and regulatory compliance. He is also adept at contract drafting, offering meticulously crafted agreements tailored to meet the unique needs of his clients. His versatile skill set and client-centric approach make him a trusted advisor for individuals and organizations seeking expert guidance in financial, corporate, and legal matters.

For any query contact- dkjainca2000@gmail.com