The article is written by Dipendra Jain (Partner) at Jain Doshi & Co.

The Ministry of Corporate Affairs (MCA) has extended the deadline for the mandatory dematerialization of securities for private companies. A notification issued on February 12, 2025, pushes the compliance deadline to June 30, 2025. This amendment revises Rule 9B of the Companies (Prospectus and Allotment of Securities) Rules, 2014, which mandates dematerialization for specific private companies. The extension provides more time for private companies (excluding small and producer companies) to complete the dematerialization process and obtain an International Securities Identification Number (ISIN). Companies must now ensure that any issuance, transfer, or alteration of securities occurs only in dematerialized form. The revised timeline eases compliance burdens and enhances transparency in securities transactions.

Applicability of Rule 9B

Rule 9B applies to all private companies except small and producer companies. Companies issuing new shares, transferring shares, or altering their capital structure must comply with dematerialization requirements. Private limited companies, including holding and subsidiary companies, must dematerialize their securities. Even if a company qualifies as a small company, it must comply if it serves as a holding or subsidiary of another corporate entity. Small companies with paid-up capital below INR 4 crore and turnover under INR 40 crore remain exempt unless they meet the above conditions. Compliance with this rule aligns private companies with regulatory standards applicable to public companies.

Objective of the Amendment

The extension aims to ease the transition for private companies struggling with compliance. It promotes market transparency and aligns private companies with the regulatory framework for public entities. The amendment facilitates investor participation and ensures a seamless transition to digital securities transactions. By enforcing dematerialization, the government aims to enhance corporate governance, reduce fraudulent share transfers, and improve record-keeping accuracy. The additional time allows companies to coordinate with depositories, registrars, and professionals to complete the process without operational disruptions.

Understanding Dematerialization

Dematerialization converts physical share certificates into electronic form, eliminating paper-based documentation. A Demat account holds these securities digitally, ensuring secure and seamless transactions. Depositories play a crucial role in maintaining electronic securities. In India, the Securities and Exchange Board of India (SEBI) regulates two depositories: NSDL (National Securities Depository Ltd.) and CDSL (Central Depository Services Ltd.). NSDL operates primarily with the National Stock Exchange (NSE), while CDSL is linked to the Bombay Stock Exchange (BSE). These institutions enable smooth securities transactions and improve transparency in the financial market.

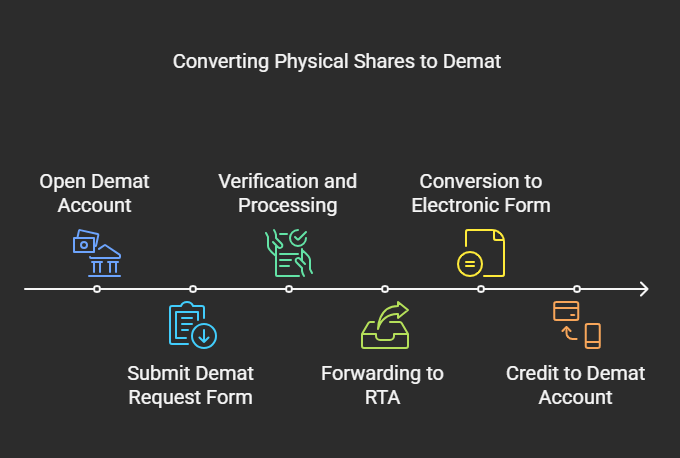

Step-by-Step Process to Convert Physical Shares into Demat

- Open a Demat Account

– Choose a Depository Participant (DP) such as a bank, stockbroker, or financial institution.

– Submit an account opening form with required documents (Bank details, PAN card, Identity & Address proof). - Submit a Demat Request Form (DRF)

– Obtain DRF from DP.

– Fill out and sign the form.

– Ensure details match company records. - Verification and Processing

– DP verifies submitted documents.

– Issues a Dematerialization Request Number (DRN) for tracking. - Forwarding to Registrar and Share Transfer Agent (RTA)

– DP forwards DRF and physical share certificates to the respective RTA. - Conversion to Electronic Form

– RTA verifies request.

– Physical certificates are canceled.

– Shares are converted into electronic format. - Credit to Demat Account

– Dematerialized shares are credited to the investor’s Demat account.

– Shares can now be sold, transferred, or pledged.

Penalties for Non-Compliance

Companies failing to comply with Rule 9B will face severe restrictions and penalties. Non-compliant companies cannot issue or allot securities, including bonus shares and buybacks. Shareholders holding physical shares will be unable to sell or transfer their securities. They may also lose eligibility for rights issues and dividend benefits. Company officers in default may face fines of up to INR 50,000, with an initial penalty of INR 10,000. Additionally, a daily penalty of INR 1,000 applies until compliance is met, subject to a maximum of INR 200,000. Ensuring compliance helps avoid these penalties and maintains seamless share transactions.

Conclusion

The extended deadline for mandatory dematerialization offers private companies a valuable opportunity to comply without penalties. Companies should take advantage of this extension to initiate and complete the dematerialization process. Obtaining ISIN and ensuring that all transactions occur in dematerialized form will enhance corporate governance and investor confidence. Companies must act proactively to meet the new deadline and avoid regulatory consequences. This transition supports India’s broader goal of strengthening transparency and efficiency in financial markets. The extension provides much-needed relief, but companies must not delay compliance further.

Ministry of Corporate Affairs, 27th October 2023, the official notification can be accessed at below link: https://www.mca.gov.in/bin/dms/getdocument?mds=ZvNqoKdfvPrRcqeoGzGdDg%253D%253D&type=open

Ministry of Corporate Affairs, 12th February 2025, the official notification can be accessed at below link: https://www.mca.gov.in/bin/dms/getdocument?mds=uB9cbvrHAgY40CP98CDaNQ%253D%253D&type=open

If you have any legal queries or require legal assistance, you can book a consultation with me: “Click Here”

Dipendra Jain is a distinguished professional with extensive expertise in taxation matters and portfolio management services. A fellow member of the Institute of Chartered Accountants of India (ICAI). In addition to his proficiency in taxation, Dipendra Jain provides comprehensive corporate legal advisory services, including company incorporation, MSME Udyam registration, and regulatory compliance. He is also adept at contract drafting, offering meticulously crafted agreements tailored to meet the unique needs of his clients. His versatile skill set and client-centric approach make him a trusted advisor for individuals and organizations seeking expert guidance in financial, corporate, and legal matters.

For any query contact- dkjainca2000@gmail.com